Who We Are

At Brego Business, our team of 200+ seasoned experts in , marketing, and finance is committed to one goal: driving your business forward.

We specialize in delivering seamless marketing and finance solutions. With over 1200+ success stories, from startups like Haptik to giants like Tata Projects, we deliver outcomes that matter.

By combining human expertise, technology, and proven strategies, we help businesses scale and thrive.

What We Do

Marketing

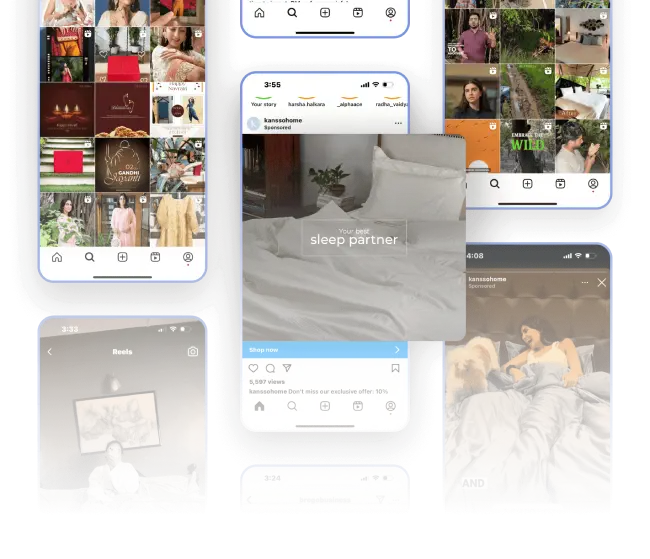

Boost Sales. Build Impact.

We create content & craft campaigns that drive results, turning ideas into revenue. From strategy to execution, we ensure your brand gets noticed and your business grows.

Finance

Streamline Finances. Maximize Value

We streamline finances and deliver insights that drive growth. From bookkeeping to virtual CFO services, we ensure clean, compliant, and goal-aligned finances.

Who We Work With

Startups

We help entrepreneurs turn ideas into multimillion-dollar ventures by navigating funding, scaling operations, and finding market fit.

Family Business

We modernise family-run businesses while preserving their legacy, driving innovation, cutting costs, and staying competitive.

Enterprises

We enable enterprises to scale globally with tailored strategies that balance local insights and global growth goals.

Why We’re Different

Tech Forward

01

A dedicated team of domain experts that leverage existing technology to drive efficiency for your business.

The result, a seamless blend of humans and technology that comes together to drive results

Deep expertise

02

The result, a seamless blend of humans and technology that comes together to drive results

Our commitment extends to both emerging startups and well-established corporations, assuring that we adapt to your evolving requirements seamlessly

Scalable

03

We’re the last services firm you’ll ever need to hire.

Our commitment extends to both emerging startups and well-established corporations, assuring that we adapt to your evolving requirements seamlessly